Does West Virginia Have State Income Tax . west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. More on west virginia taxes can be found in the tabbed. find out how to file your personal income tax return, claim credits, and pay taxes in west virginia. Property taxes (imposed at the state level by. find out how much income tax you owe in west virginia with this online tool. Enter your details and compare your federal and state taxes, as well as sales,. west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. 52 rows state taxes can include: learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. Find out how much you'll pay in taxes and what. Learn about the tax year 2023.

from www.templateroller.com

Find out how much you'll pay in taxes and what. find out how to file your personal income tax return, claim credits, and pay taxes in west virginia. Enter your details and compare your federal and state taxes, as well as sales,. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. 52 rows state taxes can include: Property taxes (imposed at the state level by. find out how much income tax you owe in west virginia with this online tool. west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. More on west virginia taxes can be found in the tabbed. learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes.

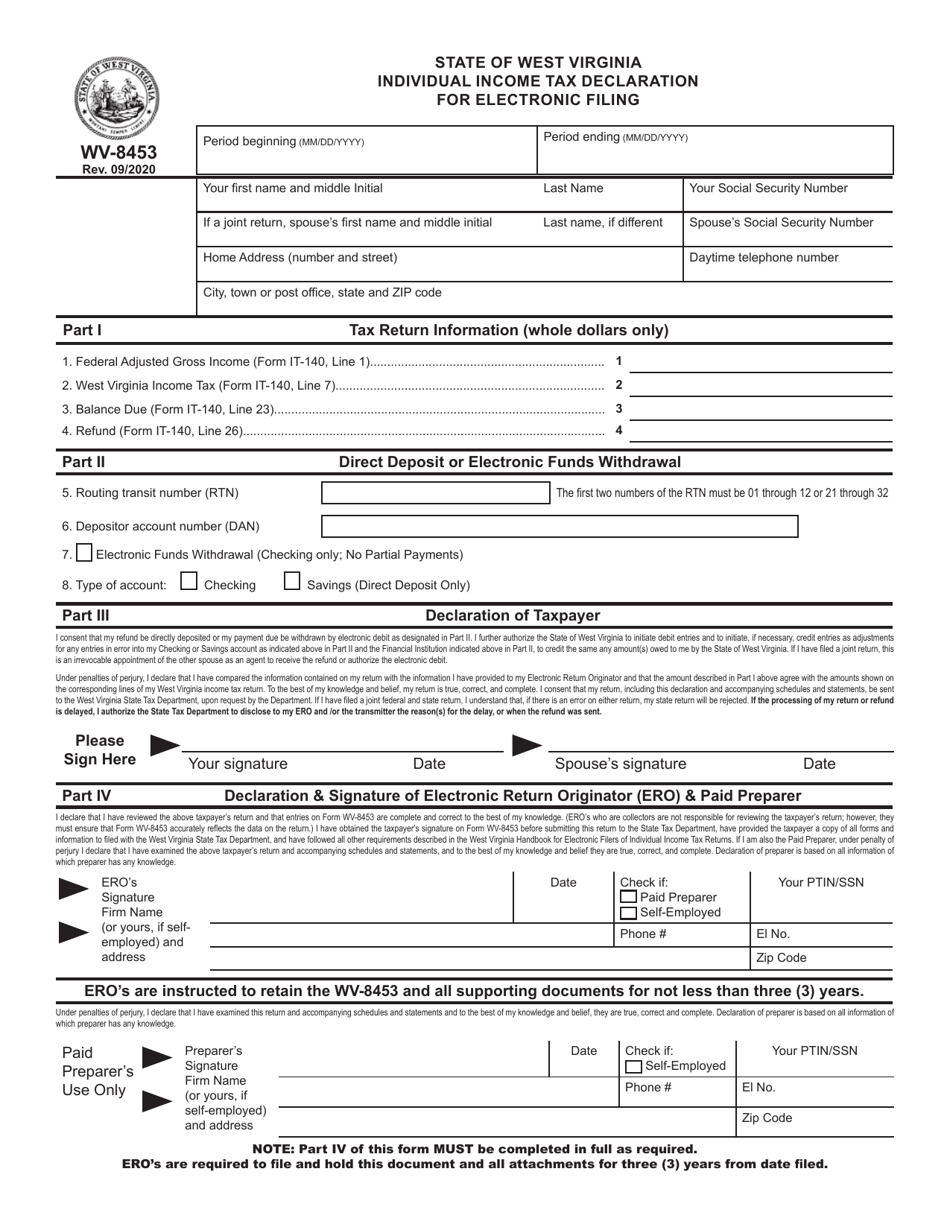

Form WV8453 Download Printable PDF or Fill Online Individual

Does West Virginia Have State Income Tax Find out how much you'll pay in taxes and what. 52 rows state taxes can include: west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. Learn about the tax year 2023. find out how to file your personal income tax return, claim credits, and pay taxes in west virginia. Find out how much you'll pay in taxes and what. Enter your details and compare your federal and state taxes, as well as sales,. More on west virginia taxes can be found in the tabbed. find out how much income tax you owe in west virginia with this online tool. learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. Property taxes (imposed at the state level by.

From blinniqrosana.pages.dev

Virginia Tax Rate 2024 Kalie Marilin Does West Virginia Have State Income Tax west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. Property taxes (imposed at the state level by. find out how much income tax you owe in west virginia with this online tool. Find out how much you'll pay in taxes and what. Enter your details and compare your. Does West Virginia Have State Income Tax.

From www.signnow.com

Does Virginia Have State Tax 20222024 Form Fill Out and Sign Does West Virginia Have State Income Tax find out how to file your personal income tax return, claim credits, and pay taxes in west virginia. Find out how much you'll pay in taxes and what. Enter your details and compare your federal and state taxes, as well as sales,. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over. Does West Virginia Have State Income Tax.

From printableformsfree.com

Virginia State Estimated Tax Form 2023 Printable Forms Free Online Does West Virginia Have State Income Tax west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. More on west virginia taxes can be found in the tabbed. find out how to file your personal income tax return, claim credits, and pay taxes in west virginia. Enter your details and compare your federal and state taxes, as. Does West Virginia Have State Income Tax.

From wvpolicy.org

How Do You Pay for a 2.1 Billion Tax Cut? West Virginia Center on Does West Virginia Have State Income Tax west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents.. Does West Virginia Have State Income Tax.

From www.dcnewsnow.com

New West Virginia House bill could lower personal taxes DC Does West Virginia Have State Income Tax learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. More on west virginia taxes can be found in the tabbed. find out how to file. Does West Virginia Have State Income Tax.

From vintti.com

West Virginia Tax Guide Essential Insights Does West Virginia Have State Income Tax find out how to file your personal income tax return, claim credits, and pay taxes in west virginia. west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. 52 rows state taxes can. Does West Virginia Have State Income Tax.

From wvpolicy.org

West Virginia Taxes At a Glance West Virginia Center on Budget & Policy Does West Virginia Have State Income Tax learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. find out how much income tax you owe in west virginia with this online tool. Enter your details and compare your federal and state taxes, as well as sales,. 52 rows state taxes can include: find out how to file your. Does West Virginia Have State Income Tax.

From www.youtube.com

West Virginia State Taxes Explained Your Comprehensive Guide YouTube Does West Virginia Have State Income Tax Learn about the tax year 2023. More on west virginia taxes can be found in the tabbed. learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. find out. Does West Virginia Have State Income Tax.

From leontynewreba.pages.dev

Virginia Individual Tax Rate 2024 Wilow Kaitlynn Does West Virginia Have State Income Tax More on west virginia taxes can be found in the tabbed. Find out how much you'll pay in taxes and what. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. Learn about the tax year 2023. learn how west virginia reduced its income tax rates by 4% in. Does West Virginia Have State Income Tax.

From taxfoundation.org

West Virginia Tax Repeal Evaluating Plans Tax Foundation Does West Virginia Have State Income Tax 52 rows state taxes can include: learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. find out how much income tax you owe in west virginia with this online tool. More on west virginia taxes can be found in the tabbed. Property taxes. Does West Virginia Have State Income Tax.

From quizzdbbackovnc.z13.web.core.windows.net

Virginia Department Of Taxation Forms 2024 Does West Virginia Have State Income Tax west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. Enter your details and compare your federal and state taxes, as well as sales,. find out how much income tax. Does West Virginia Have State Income Tax.

From www.yumpu.com

Personal Tax Forms and Instructions State of West Virginia Does West Virginia Have State Income Tax More on west virginia taxes can be found in the tabbed. learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. Property taxes (imposed at the state level by. west virginia has a. Does West Virginia Have State Income Tax.

From www.formsbank.com

Form Wv 8453ol State Of West Virginia Individual Tax Does West Virginia Have State Income Tax west virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. Find out how much you'll pay in taxes and what. learn about west virginia's income, sales, property, fuel, cigarette, and. Does West Virginia Have State Income Tax.

From www.kiplinger.com

West Virginia State Tax Guide Kiplinger Does West Virginia Have State Income Tax learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. More on west virginia taxes can be found in the tabbed. learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. Find out how much you'll pay in taxes and. Does West Virginia Have State Income Tax.

From www.formsbank.com

Form Wv/it101a West Virginia Employer'S Annual Return Of Tax Does West Virginia Have State Income Tax Property taxes (imposed at the state level by. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets. More on west virginia taxes can be found in the tabbed. Learn about the tax year 2023. 52 rows state taxes can include: Find out how much you'll pay in taxes. Does West Virginia Have State Income Tax.

From www.formsbank.com

Form Nrw2 Statement Of West Virginia Tax Withheld For Does West Virginia Have State Income Tax learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. west virginia assesses an income tax on its residents, applying rates of 3% to 6.5% over 5 tax brackets.. Does West Virginia Have State Income Tax.

From yanqin-land.blogspot.com

wv estate tax form Highest Price Biog Stills Gallery Does West Virginia Have State Income Tax learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. find out how to file your personal income tax return, claim credits, and pay taxes in west virginia. More. Does West Virginia Have State Income Tax.

From itep.org

West Virginia Who Pays? 6th Edition ITEP Does West Virginia Have State Income Tax learn how west virginia reduced its income tax rates by 4% in 2023 and 2025, and provided refundable tax credits for property taxes. learn about west virginia's income, sales, property, fuel, cigarette, and other taxes that impact residents. Enter your details and compare your federal and state taxes, as well as sales,. find out how to file. Does West Virginia Have State Income Tax.